How the U.S. Minimum Wage Laws Affect Small Businesses

Introduction

Minimum wage laws play a crucial role in shaping the labor market in the United States. While they aim to ensure fair wages for workers, they also have significant implications for small businesses. Understanding how these laws impact small businesses can help entrepreneurs navigate wage regulations, manage labor costs, and maintain profitability.

Overview of U.S. Minimum Wage Laws

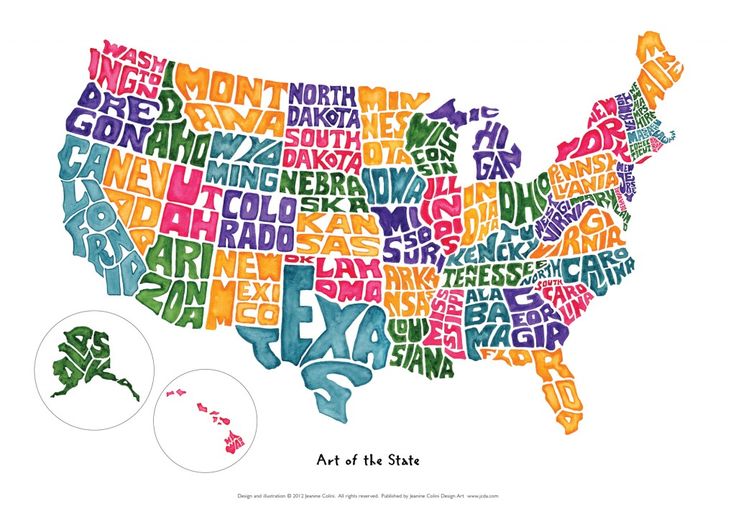

The Fair Labor Standards Act (FLSA) establishes the federal minimum wage, which currently stands at $7.25 per hour (as of 2024). However, states and local governments can set higher minimum wages, leading to variations across the country. Some states, such as California and New York, have significantly higher minimum wages, exceeding $15 per hour.

Key Aspects of Minimum Wage Laws:

- Federal Minimum Wage: The baseline wage set by the FLSA.

- State and Local Variations: Higher wages in certain states and cities.

- Industry-Specific Regulations: Some industries, like hospitality and agriculture, may have special wage rules.

- Tipped Employee Wages: Lower base wages for tipped employees, with tips making up the difference.

How Minimum Wage Laws Affect Small Businesses

While minimum wage increases benefit workers, they can pose challenges for small business owners who must balance labor costs with profitability.

1. Increased Labor Costs

Higher minimum wages mean higher payroll expenses for small businesses. This can lead to:

- Reduced hiring or job cuts to control costs.

- Increased prices for goods and services to offset wage hikes.

- Lower profit margins, especially for businesses with tight budgets.

2. Potential Reduction in Workforce

To adjust to wage increases, some small businesses may:

- Cut hours for existing employees.

- Reduce staff and rely more on automation or outsourcing.

- Shift to independent contractors instead of full-time employees.

3. Impact on Business Growth

Higher wages can affect expansion plans by limiting resources for:

- Opening new locations.

- Investing in equipment and technology.

- Expanding product or service offerings.

4. Improved Employee Retention and Productivity

On the positive side, higher wages can lead to:

- Lower turnover rates, reducing hiring and training costs.

- Higher employee morale and productivity.

- Increased consumer spending, which can benefit local businesses.

5. Competitive Disadvantages

- Small businesses may struggle to compete with larger corporations that can absorb wage increases more easily.

- Online and automated businesses may gain an edge over labor-intensive small businesses.

Strategies for Small Businesses to Adapt

1. Adjust Pricing Strategies

- Incremental price increases to cover wage hikes.

- Value-added services to justify higher prices.

2. Improve Efficiency

- Investing in automation and technology.

- Streamlining operations to reduce waste and inefficiencies.

3. Offer Non-Monetary Benefits

- Flexible work schedules and remote work options.

- Employee training programs to increase job satisfaction.

4. Leverage Tax Credits and Incentives

- Taking advantage of small business tax credits.

- Applying for government grants and wage subsidies.

Conclusion

Minimum wage laws have a profound impact on small businesses, influencing labor costs, workforce decisions, and business growth. While wage increases can present financial challenges, strategic planning and operational adjustments can help small businesses remain competitive and sustainable in a changing labor market.

Leave a Reply